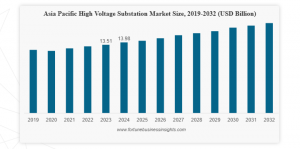

High Voltage Substation Market Size Worth USD 37.55 Billion by 2032, Growing at 1.84% CAGR

The market is projected to grow from USD 33.04 billion in 2025 to USD 37.55 billion by 2032, exhibiting a CAGR of 1.84% during the forecast period.

The Asia Pacific dominated the high-voltage substation market with a share of 43.30% in 2024.”

PUNE, MAHARASHTRA, INDIA, October 1, 2025 /EINPresswire.com/ -- The global high voltage substation market was valued at USD 32.28 billion in 2024 and is forecast to expand steadily, reaching USD 37.55 billion by 2032. This reflects a compound annual growth rate (CAGR) of 1.84% from 2025 to 2032. In 2024, Asia Pacific accounted for the largest regional share at 43.30%, underscoring its role as the industry’s growth hub.— Fortune Business Insights

Market momentum is fueled by rising global electricity demand, the integration of utility-scale renewable power, and rapid urbanization. These factors require reliable power infrastructure capable of efficiently transmitting and distributing electricity over long distances. Substations remain essential for voltage regulation, grid stability, and minimizing losses in power networks.

Technological transformation is also reshaping the sector. Substations are evolving beyond traditional configurations into smart systems equipped with Internet of Things (IoT), artificial intelligence (AI), and advanced communication capabilities. This allows real-time monitoring, predictive maintenance, and higher efficiency. Major manufacturers such as ABB are leading innovation by offering a broad portfolio of transformers, switchgear, and digital control systems, strengthening their global presence.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/113531

Market Dynamics

Drivers – Expanding Energy Needs

Rising electricity consumption worldwide is a primary growth driver. According to the International Energy Agency (IEA), global energy demand increased by 2.2% in 2024, with emerging economies accounting for 80% of this growth. The development of industries, urban centers, and data-intensive technologies such as cloud computing and AI is adding strain to power systems, necessitating grid upgrades and new substations.

The transition toward renewables such as wind and solar, often situated far from demand centers, further boosts the need for high-voltage substations to transmit power efficiently across long distances. In addition, many existing networks are aging and require modernization to maintain resilience, reinforcing the demand for new installations.

Restraints – Rise of Microgrids

At the same time, the market faces constraints from decentralization trends. Microgrids and off-grid renewable systems reduce reliance on large centralized substations. Communities in remote or underserved regions increasingly adopt solar plus battery solutions, bypassing conventional transmission infrastructure. This shift toward distributed power generation could temper the expansion of traditional high-voltage substations.

Opportunities – Renewables Integration

On the opportunity side, renewable integration continues to create promising prospects. Large-scale solar and wind farms require advanced substations to connect to national grids and balance intermittency. Governments and utilities worldwide are investing in smart grids and digital substation technologies to enhance reliability and operational efficiency. For example, in January 2025, National Utilities Laboratories partnered with Indian state authorities to develop strategies for large-scale renewable integration.

Trends – Long-Distance Transmission

A prominent trend is the development of long-distance transmission corridors, where high-voltage substations play a vital role in minimizing energy loss and reducing infrastructure costs. Countries such as China and Brazil are investing heavily in ultra-high voltage projects to integrate renewables and enable cross-border grid connectivity. In January 2025, Adani Energy Solutions Ltd. acquired the Rajasthan Part I Power Transmission project in India, reinforcing the growing importance of large-scale transmission assets.

Segmentation Analysis

The market is segmented into Gas-Insulated Substations (GIS), Air-Insulated Substations (AIS), and hybrid models. Air-Insulated Substations hold the largest share, primarily due to their cost-effectiveness and simpler maintenance. Though AIS requires more physical space and is sensitive to environmental conditions, it remains the preferred choice in regions with abundant land. For instance, General Electric signed an agreement in 2023 to build two 500 kV AIS units in Brazil for a major wind complex.

High-voltage substations are used in transmission and distribution networks. The distribution segment dominates due to the growing need for reliable, loss-minimized power delivery across long distances. Distribution substations also offer advantages such as reduced land use, higher safety, and improved system efficiency, making them increasingly attractive for modernization projects.

Utilities represent the largest end-user segment, supported by the push to expand large-scale grid infrastructure. Utility-scale renewable projects require substations to connect remote generation sites to demand centers. In April 2024, Hitachi Energy secured a contract in India for a 950 km HVDC transmission system capable of carrying 6 GW, demonstrating the scale of opportunities in this segment.

Have Any Query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/113531

Regional Outlook

In North America, market growth is driven by modernization initiatives, surging electricity demand, and the rapid expansion of data centers. The U.S. government launched a grid expansion initiative in 2024 to extend 100,000 miles of transmission lines over five years. Aging infrastructure and the rise of digital industries make the region a key market for substation upgrades.

Europe faces a dual challenge of replacing aging assets and supporting renewable integration. The European Commission announced major investments in 2024 to modernize the continent’s grid infrastructure by 2030. Smart grids and renewable electrification will require widespread deployment of advanced substations.

Asia Pacific leads the global market, supported by massive investments from governments such as China’s USD 77 billion annual commitment to transmission upgrades. Rapid urbanization, industrialization, and renewable adoption in China, India, and Southeast Asia continue to fuel demand for new substations and modernization projects.

Latin America benefits from abundant renewable resources. Countries such as Brazil and Mexico are expanding high-voltage networks to transmit solar, wind, and hydropower over long distances. Modernizing outdated grids remains a priority to support energy transition goals.

The MEA region is experiencing rising electricity demand due to rapid urban growth and industrial development. Countries such as Saudi Arabia, the UAE, Nigeria, and South Africa are investing in new transmission lines and substations to strengthen grid reliability.

Competitive Landscape

The high voltage substation market is moderately consolidated, with key players including ABB, Mitsubishi Electric, Siemens, Hitachi Energy, Schneider Electric, Rockwell Automation, and Eaton. These firms compete through technological innovation, strategic contracts, and partnerships with governments.

For instance, in February 2025, Belgium approved construction of a new high-voltage substation between Massenhoven and Van Eyck. Similarly, Transgrid of Australia partnered with Hitachi Energy in January 2025 for the HumeLink transmission expansion project. Such projects highlight the emphasis on strengthening national grids to accommodate future energy demands.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/113531

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.